The Collaborative Financial Planning Process

Working with a comprehensive financial advisor typically follows a structured, collaborative process designed to build a personalized plan.

1. Discovery & Goal Setting: Understanding your current financial situation, values, priorities, risk tolerance, and defining specific, measurable, achievable, relevant, and time-bound (SMART) goals.

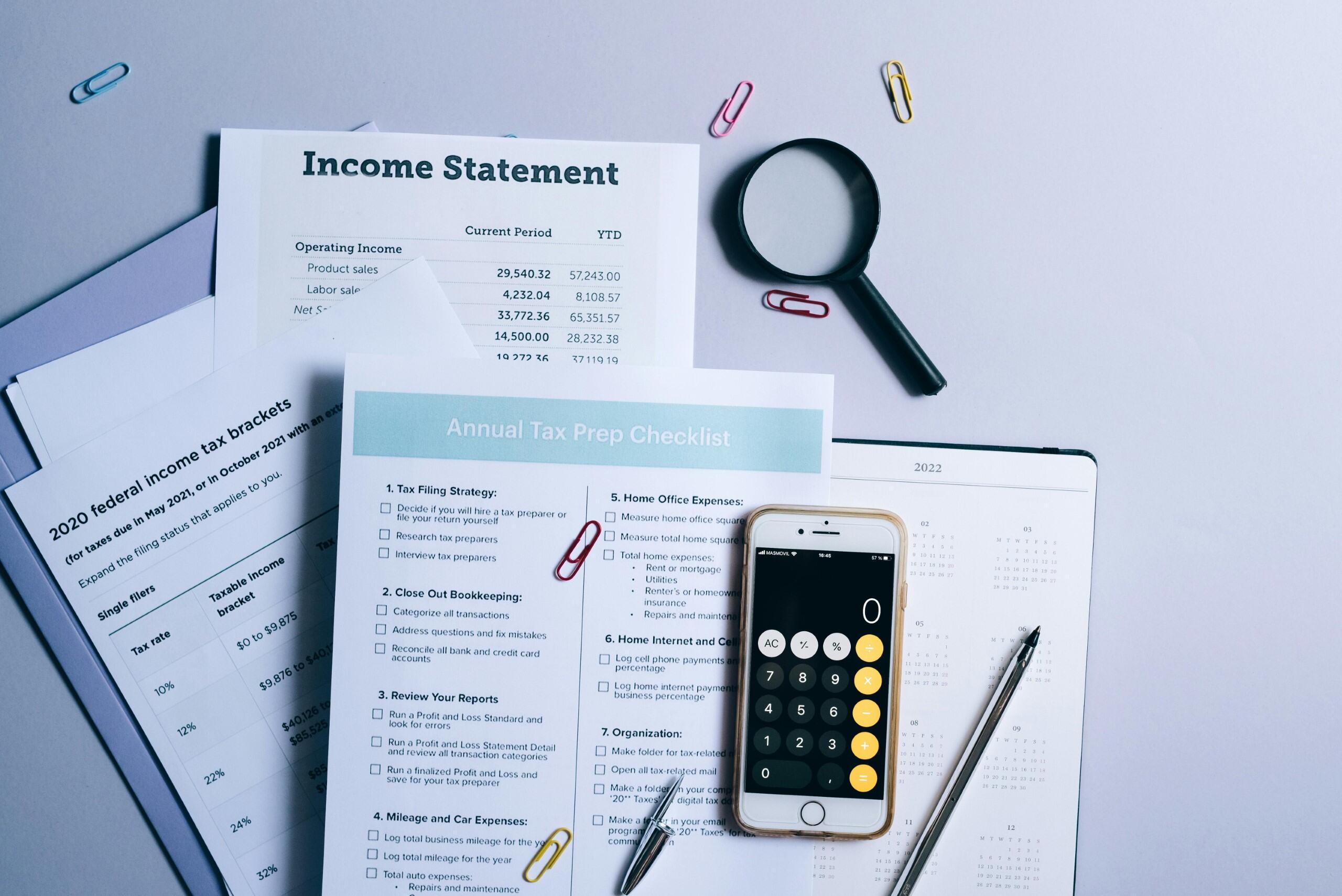

2. Data Gathering & Analysis: Collecting detailed financial information (assets, liabilities, income, expenses, insurance, wills) and analyzing your current financial health and trajectory towards your goals.

3. Strategy Development & Recommendations: Based on the analysis, the advisor develops tailored strategies and specific recommendations across relevant areas (investing, retirement, tax, etc.) presented in a financial plan.

4. Implementation: Putting the agreed-upon recommendations into action. This might involve opening accounts, selecting investments, purchasing insurance, or coordinating with lawyers/accountants.

5. Monitoring & Review: Regularly tracking progress, reviewing portfolio performance, discussing life changes, and making necessary adjustments to the plan to keep it aligned with your goals over time.

)